August has historically been a rough month for markets. This year proved no different as the stock rally ground to a halt.

Stocks tumbled before paring back some of their losses, with Wall Street still trying to figure out when the Federal Reserve will end its long campaign of interest rate hikes.

There were some sources of optimism amid the gloom. The US dollar snapped a two-month losing streak and Nvidia’s share price reached a record high following a stellar second-quarter earnings report. However, the S&P 500 did not fare as well being down more than 3% until the final days sparked a small rally recapturing some of the losses.

These pullbacks are a contrast to the market rally seen earlier this year. The Nasdaq Composite had its best first-half performance in 40 years in 20231. The S&P 500′s gains over the first six months of the year marked the index’s best start to a year since 2021.

If things are so good, then why are things so bad?

There are several things pressuring Wall Street now, ranging from seasonal factors to concerns about the global economy and the Federal Reserve.

Lower trading volumes: Trading tends to decline in August as traders and investors go on vacation before the summer ends. This can lead to more volatile swings in prices.

- Booking profits before September: While August is a tough month for Wall Street, it has nothing on September — historically the worst of all months for the market. The S&P 500 has averaged a 0.5% loss in September over the past 20 years. Over the past 10 years, the S&P 500 has fallen an average of 1% each September.

Additionally, it’s not all flowers out there…..

- Economic data out of China has been lackluster, to say the least. The world’s second-largest economy earlier this month reported much weaker-than-expected retail sales growth for July, while industrial production also rose less than expected.2

A slowdown in China’s economy could spell trouble for markets around the world, including the U.S., given the sheer number of major corporations that rely on the country as a strong source of revenue.

- Another source of market pressure last month has been concern that the Fed will keep its benchmark lending rates higher for longer than anticipated. Meeting at Jackson Hole Wyoming, the Fed noted that central bank officials still see “upside risks” to inflation — which could lead to more rate hikes. Specifically, the central bank said: “With inflation still well above the Committee’s longer-run goal and the labor market remaining tight, most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy.”2

So what now?

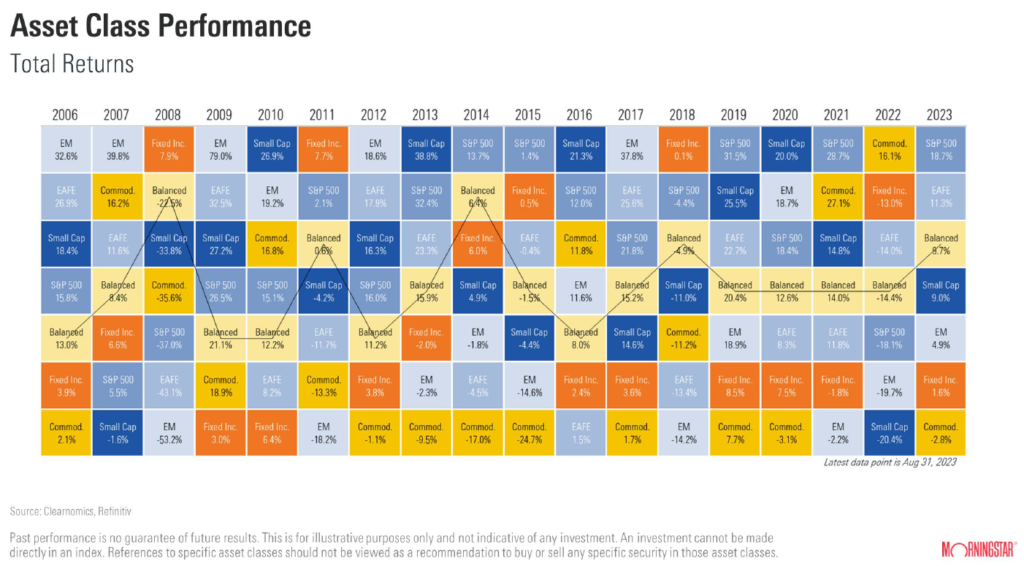

According to Morningstar, a balanced portfolio in 2023 has returned approximately 9.7% through August 31, 2023. I repeat 9.7% vs the S&P 500 (or should I say Nvidia, Amazon, Microsoft, Apple, Alphabet, Meta and Tesla). This is not your typical market and it shows.

Our recommendation maintains a defensive approach to investing. There’s a lot happening in the world today. Sometimes it’s best to be patient and wait out the storm. Until next time….

Source 3: Morningstar