Happy New Year!!!

Can’t believe we are in 2024. How time flies!!! If we rewind the clock one year, analyst forecasted the following for 2023: “2023 will more than likely be a continuation” of 2022 … “and a cautious outlook seems prudent. … Moreover, cash will play a major role both for buying opportunities and for hedging risks against market pullbacks.”

For the most part, we were correct…. Until we weren’t. From February of last year until October the markets did not provide a lasting return exempt the tech darlings in Nvidia, Tesla, Amazon, Microsoft, Apple, Alphabet and Meta which accounted for nearly 2/3rds of the gains last year. All across Wall Street the mood was glum on equities and bonds in 2023. Whether it was Morgan Stanley, Bank of America or Goldman Sachs… the consensus was buy treasuries!!1 This was safe, but at the end of the day…. they were all wrong!!! What was supposed to go up went down, or listed sideways, and what was supposed to go down went up — and up and up. The S&P 500 climbed more than 20% and the Nasdaq 100 soared over 50%, the biggest annual gain since the dot-com boom. “I’ve never seen the consensus as wrong as it was in 2023,” said Andrew Pease, the chief investment strategist at Russell Investments. “Everyone got burned!” So much so that Wall Street — is now in a very uncomfortable position with investors across the world who pay for their opinions and advice.

So what did we learn?

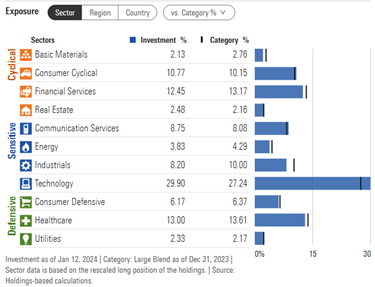

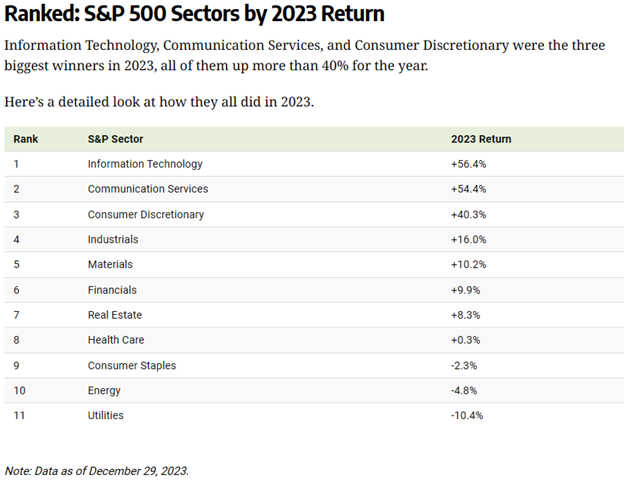

2023 proved that investing is a long-term commitment that should be consistent with long-term goals. Why? Below is a sector breakout of the S&P 500:

* Source: MorningStar Investor

* Source: Charted: S&P 500 Sector Performance in 2023 (visualcapitalist.com)

As you can see from the above, being defensive did not help your portfolio when the largest returns came from Technology, Communications and Consumer Discretionary. However, most of Wall Street led investors to believe 2023 would be a pullback year. However, if one ignored the analyst and stuck to their long-term objectives, they may not have gotten a 20% return, but they did experience a quality return with lower risk. I get it, EVERYONE including Warren Buffet wants to get it right 100% of the time, but that is unrealistic and impossible. Sticking to your plan works!!! 20 plus years in this business has taught me that the most successful investors focus on their goals not the market. In doing so, they tend to live a very comfortable lifestyle.

So for 2024, our objective is to stay focused on you, your goals and your lifestyle. In doing so, we can achieve so much more for years to come. I’m looking forward to it and hope that you are too!!