Financial Planning itself is different from traditional investing in that the focus is not just on stocks and bonds. You are more than the markets and your wealth goes beyond money. We invest to improve both your investments and your quality of life. And when you have a family or a business, you want an Advisor that provides guidance on ALL that you cherish and not just on how much money you gave them. In return, your potential for greater returns goes beyond investment growth.

This type of research or planning could literally save you thousands if not hundreds of thousands over the years. For example, if you are considering a home refinance with interest rates at historically low levels, that would seem to make sense. But when looking at the cost to refinance relative to long-term savings, you may discover that the cost to refinance could last longer than desired, eroding future savings. This is the exact opposite of the intent. But we assume we are saving when in fact you could be paying more…. A lot more.

Support

Fees

Technology

Services

Financial Planning

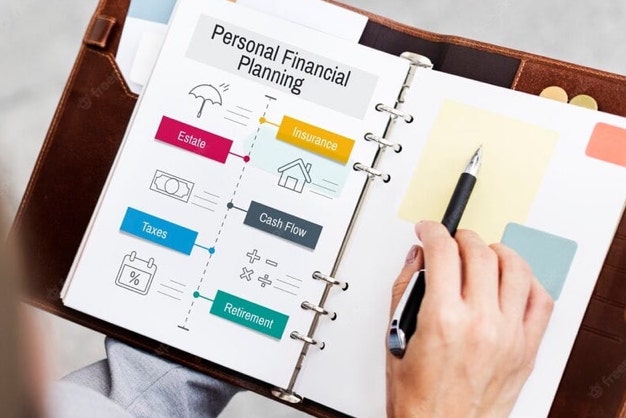

Financial planning is an ongoing process that involves goal setting, cash flow management, risk management, investment management, asset protection, healthcare planning, tax planning, and estate planning. iPlan aims to provide solutions for every “what if” in your life.

Investment Management

The art of protecting your lifestyle, assets and needs begin with implementing a customized financial plan and an Investment Policy Statement or IPS where investment goals and targets drive returns, and not the other way around.

Financial Literacy

You are more than stocks and bonds. Does your planning reflect this? Using social media platforms, we regularly post and host webinars and podcast aimed at making you a better manager of your wealth.