Winter is coming: What we know

What we know is that the S&P 500 hit an all-time high of 4,818.62 on January 4. We also know that it hit a low of 3,491.58 on October 13.

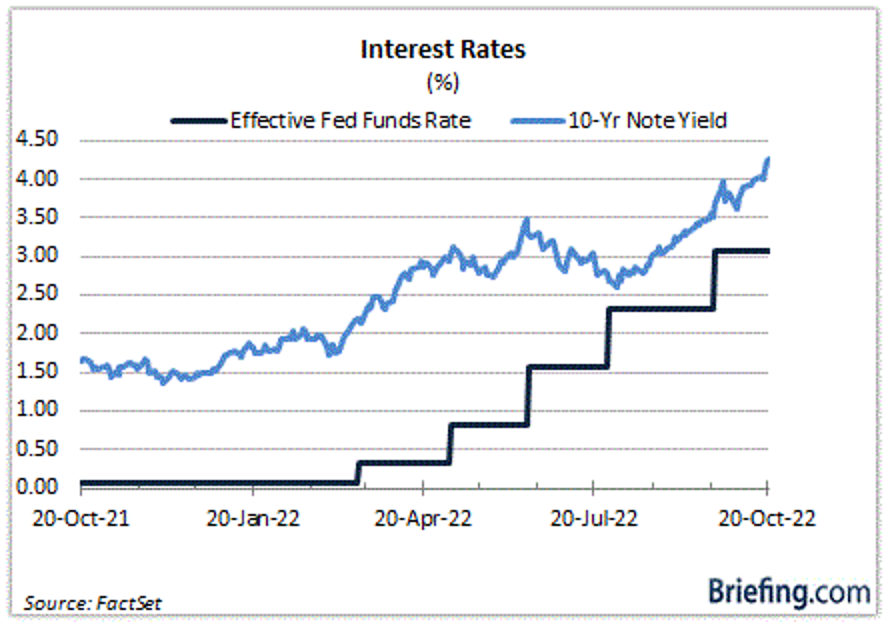

There have been a lot of changes since January 4 – war in Ukraine, Covid related supply chain issues, inflation and probably none more meaningful for stocks AND bonds than the change in the fed funds rates.

Not to be too technical, but on January 4 the target range for the fed funds rate stood at 0.00-0.25% while the 10-yr note yield rested at 1.67%. Today the target range for the fed funds rate is 3.00-3.25% and the yield on the 10-yr note sits uneasily at 4.26%.

We can say without hesitation that the high point in the fed funds rate has not been reached. With the Fed announcing the fourth straight increase, this time 75-basis points, market volatility continues.

Now what?

As of this writing, the S&P 500 is down -21.12% for the year. The Vanguard Balanced Index hasn’t done that much better being down -17.48% for the year. So where do we go from here? I don’t mean to sound like a broken record, but you stick to your plan – that is if you have one. In this case, you should have two (2) plans:

1. Financial Plan (we’ve discussed this in prior newsletters) and an

2. Investment Plan using Dollar Cost Averaging (if you are looking at a longer term investment objective)

That is, you stick to a regular investment plan no matter how bumpy the road is, investing a smaller fixed dollar amount on a recurring time frame no matter what the price is. Sometimes it will be more expensive, and you won’t be able to buy as many shares, and sometimes it will be cheaper, enabling you to buy more shares.

For those with shorter time horizons, this may not be a comfortable market right now, but with the sharply reduced stock prices, it is hard to deny that prices are lower making dollar-cost averaging more attractive. Personally, I don’t expect to see positive numbers by Christmas, but there is still plenty of room for improvement and that would be a welcome sight after the past year.

We are less optimistic about the bond market. With the Fed continuing its effort to curb inflation by aggressively increasing interest rates, the bond market is likely to continue hurting for some time. That’s because the value of bonds goes down as interest rates rise. We don’t expect bonds to bottom, at least not in a meaningful way, until the Fed stops raising rates. But that might still be a while.

Bottom Line:

This is not the best year for the markets. Both stocks and bonds are down offering very little in terms of shelter. This is a fact whether you are on Wall Street or Main Street. Luckily, our models called for larger cash positions early on in the year muting much of this volatility, especially once we got past Q1. So we believe we are in good shape to catch a rebound once things slowly recover. For now, we sit tight and stick to the plan. For those of you that need a plan… iPlan. Do you?